### Can One Person Collect Debt on Behalf of Another?

Debt collection is a common practice in the financial world, and it often raises questions about legality, ethics, and personal responsibility. One of the most frequently asked questions is whether one person can collect a debt on behalf of another. This article will explore the various aspects of debt collection, including legal frameworks, ethical considerations, and practical implications.

#### Understanding Debt Collection

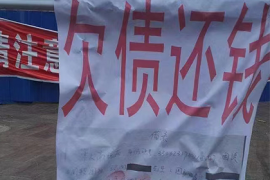

Debt collection refers to the process of pursuing payments owed by individuals or businesses. This can occur in various contexts, such as personal loans, credit card debts, or business transactions. When a debtor fails to make payments as agreed, creditors may seek to recover the owed amount through various means, including hiring a third-party collection agency or taking legal action.

#### Legal Framework

The legality of one person collecting debt on behalf of another largely depends on the jurisdiction and the specific circumstances surrounding the debt. In many countries, there are laws that govern debt collection practices to protect consumers from harassment and unfair treatment. For instance, in the United States, the Fair Debt Collection Practices Act (FDCPA) outlines what debt collectors can and cannot do when attempting to collect a debt.

In general, if an individual wishes to collect a debt on behalf of another person, they may need to have legal authorization or a formal agreement in place. This could take the form of a power of attorney or a written agreement that specifies the terms under which one party can act on behalf of another. Without such authorization, attempting to collect a debt could lead to legal complications.

#### Ethical Considerations

Beyond legalities, there are ethical considerations involved in debt collection. The relationship between the debtor and creditor can be complex, and involving a third party can complicate matters further. For example, if a friend or family member attempts to collect a debt on behalf of someone else, it could strain personal relationships and lead to feelings of resentment or betrayal.

Moreover, ethical debt collection practices emphasize transparency and respect for the debtor's situation. A third party collecting a debt should approach the situation with empathy and understanding rather than aggression or intimidation. This is particularly important when dealing with individuals who may be experiencing financial hardship.昆明收债公司

#### Practical Implications

From a practical standpoint, having someone else collect a debt can be beneficial in certain situations. For instance, if the original creditor feels uncomfortable confronting the debtor directly, enlisting a third party may help facilitate communication. Additionally, professional debt collectors often have experience navigating difficult conversations and may be more effective in recovering funds.

However, there are also risks involved. If the third party does not adhere to legal guidelines or ethical standards, it could result in negative consequences for both the creditor and debtor. For example, aggressive collection tactics could lead to complaints or lawsuits against the collector, damaging their reputation and potentially harming their ability to collect debts in the future.

#### Conclusion

In conclusion, while one person can collect debt on behalf of another under certain conditions, it is essential to consider the legal and ethical implications involved. Having proper authorization is crucial to ensure that the process remains within legal boundaries. Additionally, approaching debt collection with empathy and respect can help maintain relationships and foster positive outcomes for all parties involved.

Ultimately, whether one person should collect debt on behalf of another depends on various factors, including the nature of the relationship between the parties involved and their willingness to navigate potential challenges together. Open communication and mutual understanding are key components in ensuring that debt collection is handled appropriately and effectively.